The word ‘evolution‘ is generally defined by a sense of growth or improvement over time. Living things evolve, as do more theoretical things, such as ideas, processes, societies and technology. Evolution surrounds us.

Applied to real estate, the concept of evolution is most apparent in the stages of growth the best buyers go through on their quest to buy a home.

How Do Buyers Evolve?

It is important to begin with the following statement – the market that exists today has not been seen since approximately 1994 and the home buying experience of the period of 2003-2012 has almost zero resemblance to the buying experience of today. The importance of this cannot be understated and as soon as a buyer understands that what they remember about buying a home 5-10 years ago (or more) will offer little value to the process of home buying today. Even the buying experience from as little as a few years ago differs radically from that of today. The current market has inventory conditions tighter than any period in modern history and the Dodd-Frank Act has permanently altered the mortgage markets in ways we are still discovering.

Evolutionary Stage One | All of the Good Cheap Houses Sold in 2009 and 10

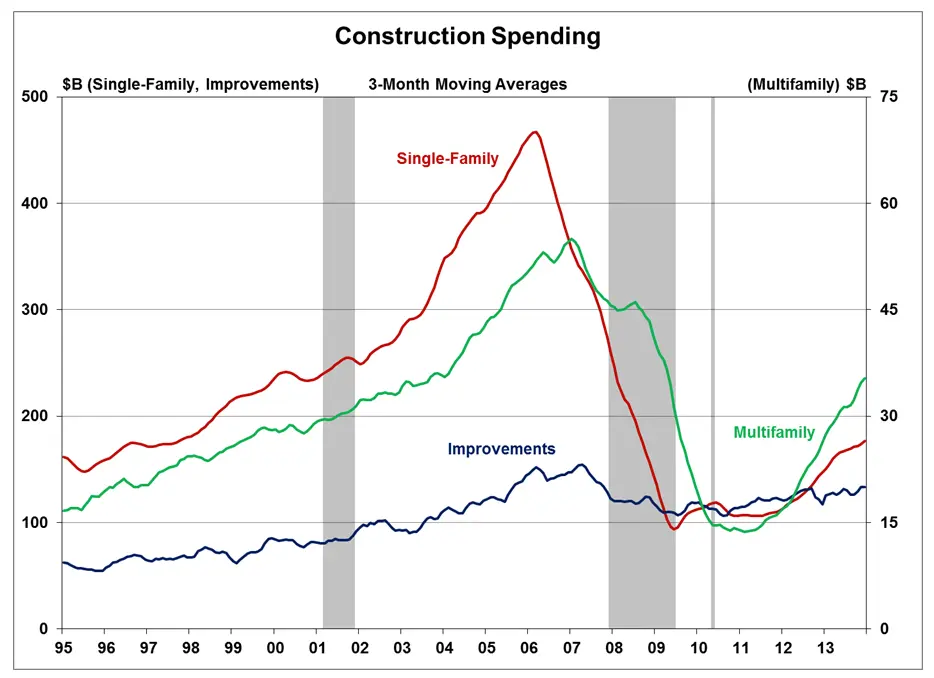

When the market rolled over, demand for housing stopped before production ceased. Effectively, the lag time between when everyone realized the magnitude of what was happening and when nail guns fell silent, meant that we continued to produce homes at an incredible pace for an additional 6-9 months despite demand falling to almost zero. The US created roughly 2 million new homes in 2007. By 2009, we built less than 500,000.

As prices began to stabilize, largely due to the absorption of this inventory, the buying public began to show up to buy, only to find out that the 20-30% discount on great home was no longer an option.

Evolutionary Stage Two | Every House I am Interested in Sells Before I Can Get to It

I believe each Realtor somehow knew that when the market turned, it would turn quickly (the inventory graph below tells the story better than any words ever could.)

Market values by 2010 were as far below trend as the values had been above trend in 2007. By 2015, the same conditions which drove the market to its heights (far too much demand for the existing supply) were about to occur again, albeit for a different reason (far too little inventory for the existing demand). The spring markets of the last several years brought bidding wars, multiple contracts and escalation clauses (all hallmarks of 2006/7) in many sub-markets of Richmond. The conditions are unlike to change as building has still not caught up with demand and ‘quality’ don’t sit around long, especially in mature neighborhoods.

Expecting to be able to take your time and sit on your decision for several days will result in lost opportunity.

Evolutionary Stage Three | Every Contract Price Seems to Be Higher than I Expect!

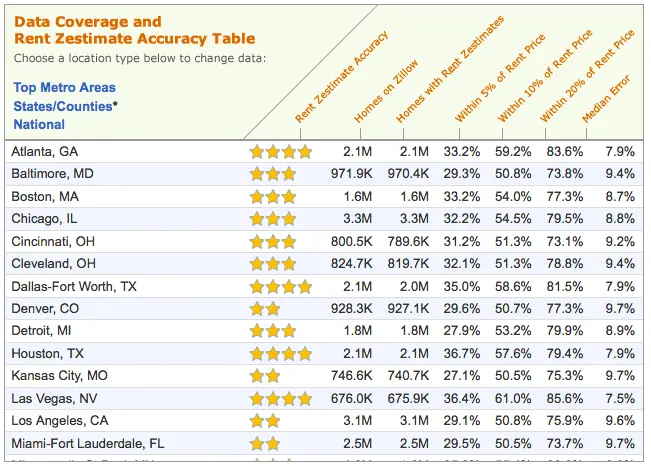

Appraisals, assessments and Trulia/Zillow estimates are all driven by comparable sales. Comparable sales are PAST events and represent where we WERE and not where we ARE. If you are exclusively using events from the past to drive current decisions, your estimates of value will feel low relative to the actual market values. While this may feel slightly disconcerting, the same statement can be said during the free fall of the market in 2009 (albeit in the exact reverse) meaning everyone felt as if they were making great below market deals, only to find out the market was falling faster than they realized. Past events are helpful in establishing where we have been…use them for that purpose.

Evolutionary Stage Four – Every Seller (and/or listing agent) is Becoming Unrealistic Again

Denial of reasonable repair requests, refusal to renegotiate when appraisals miss, ‘shopping’ contracts, missed deadlines for response, pocket listings … they are all starting to occur again. When response times are not honored, contract agreements ignored or other behaviors designed to extract value after the fact, buyers become frustrated and decision making becomes poor. Just remember, when the market was flipped, buyer behaviors exhibited in 2009/10 were exactly the same. When one side of the market has an extreme upper hand, they will act accordingly.

When you are buying into a tight market, expect these behaviors. Being surprised or frustrated by questionable seller behaviors is a recipe to miss the bigger picture.

Evolutionary Stage Five – Trulia and Zillow are Total Crapshoots and Cannot be Trusted, Despite Some Really Great Commercials

In 2009, Trulia and Zillow were nothing more than websites with funny names. This is no longer the case.

Today, T/Z (unfortunately) represent the housing gospel in many folk’s minds and thus (poorly) impact many buyer and seller decisions. It is one of the most unfortunate developments in our industry in the past 5 years. Simply put, the data that T/Z use is not accurate and thus, their estimates of value are poor (I am being kind) and inventory they represent as available is questionably accurate.

For reasons I am not entirely sure I understand, many feel that a computer in either Seattle or San Francisco knows more about the market than those locals who live it and breathe it daily. T/Z, are amazing technological achievements and offer some great tools, it is just that which they do most poorly (value estimates and availability) is what they tout as their best features.

If you wish to rely on T/Z to help you buy a home, I wish you the best of luck.

Evolutionary Stage Six – Appraisers and Underwriting Departments are Petrified of Mistakes Thanks to Dodd-Frank

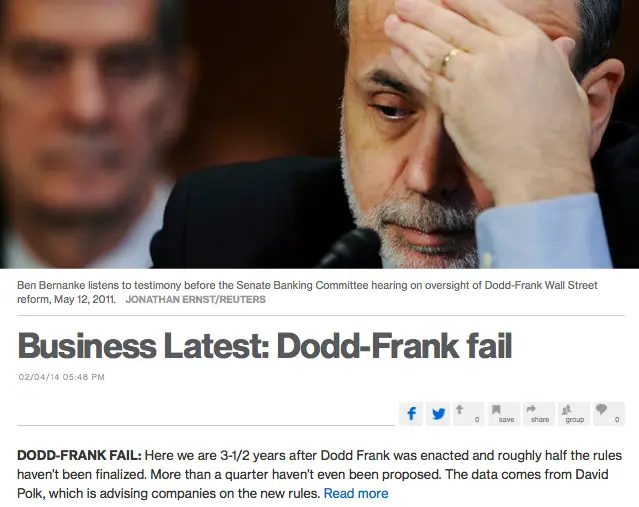

The Dodd-Frank Consumer Protection Act is another classic example of government intervention negatively impacting the market it was created to protect. Dodd Frank increased regulation, capped compensation to lenders, decreased product choices and created additional bureaucracy. It has effectively slowed the market and increased the cost of administration. It was also enacted well after the financial crisis had occurred and largely repaired itself.

In the short run, the act has created an atmosphere where decision makers are waiting for legal precedent to guide their actions (think ‘lawsuits’.) Even several years after passing the law, only half of the over 400 new rules created under the act have been finalized…The level of uncertainty created by Dodd-Frank is staggering. Currently, those in the mortgage business have little guidance and therefore, decision making is stiflingly slow and conservative. Any loan which does not fit nicely into the proscribed box (think ‘most every loan’) represents an unnecessary challenge.

Evolutionary Summary

At the end of the day, the evolution one must go through has more to do with understanding market conditions than anything else. The past 5-7 years has brought about monumental shifts in values, processes and inputs unprecedented in any time in history. Failure to recognize not only the difference in the process, but the impact of the differences will lead to failure.

Nothing about today’s home buying bears any resemblance to the past and those who seek to compare the two are destined to struggle.