- “What should we offer?”

- “Should we take it or should we push back?”

- “Tell them to take it or leave it!”

When to Push Back

Having a sense for whether or not to push back one (or more) times in an attempt to maximize your yield is hard. No matter what the scenario, having more information is better than having less. Knowing where you stand relative to the market is critical in capturing that last several thousand dollars.

While there are many ways to analyze your place in the market, one of my favorite charts to help offer guidance is below. The chart shows the percentage of the home’s asking price that a seller received (sometimes called the Ask/Bid Spread). When inventory levels tighten or demand increases typically, the higher the percentage. You will also see the ‘Days on Market’ statistic move in concert with the Ask/Bid as when demand increases, buyers will act more quickly and thus tend to pay prices closer to asking prices in order to secure the right to purchase the home.

You can toggle on or off the individual zip codes (click the dots below the chart) to compare how one is preforming relative to another.

Numbers Never Lie, Right?

“So we should follow the chart above, correct?”

Not necessarily.

All statistics contain some ‘noise’ which can skew results and/or give less than accurate guidance. And while each individual MLS handles their statistical packages differently, all MLS’s should offer some sort of package to help both agents and the public make some sense of the data.

So when looking at the charts above, please keep in mind the following:

- Most statistics packages use Zip Codes, not MLS Zones, so some zips may encompass radically different neighborhoods. This more typical in the urban zips.

- New Homes are typically entered into MLS at 100% (or more) of asking price so zip codes with larger numbers of New Homes may have slightly higher percentages than the market is really dictating. Conversely, resale homes in new home neighborhoods may be in weaker bargaining positions than the chart would indicate.

- 23220/23221/23226 have a smaller data size so the percentages will bounce around more. Smaller data sets are also more more skewed by an extreme individual sale.

Dig in, Move or Accept?

So should you dig in and fight for that last little bit when selling your home? Simply put, it depends.

Remember, there is no magic formula as each purchase/sale event is unique. We wrote a post about using COMPS exclusively in the analysis which discusses the issue of looking backwards to predict future events. We also wrote a post about understanding the difference between the many different interpretations of value. But just know that those who know how interpret data will always come out ahead.

Ask your agent about the stats and see what they say…

[

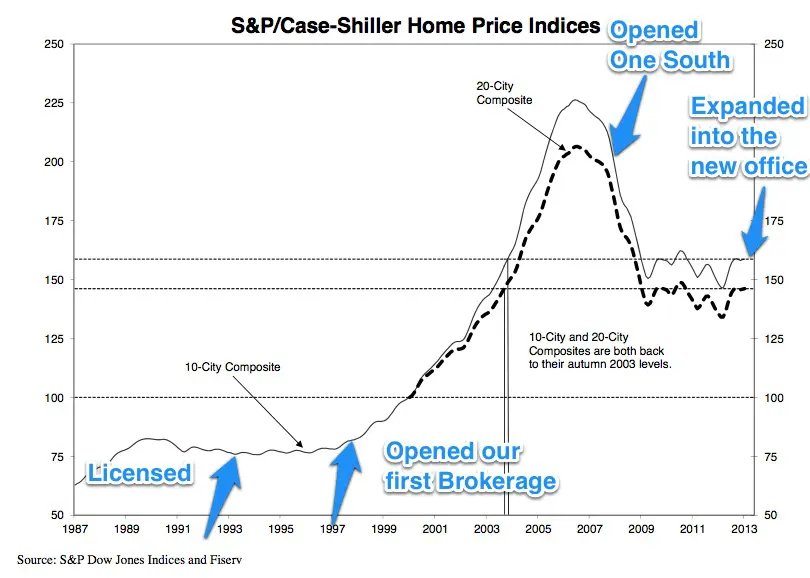

[  History also plays a role.

History also plays a role.

A buyer’s agent works for YOU when you buy a home.

A buyer’s agent works for YOU when you buy a home.