I didn’t think I’d ever write a blog like this, honestly.

The idea that, in less than 2 weeks, a heretofore unheard of virus, named similarly to a beer you drink on vacation, could essentially toss a monkey wrench into our lives … well, that wasn’t really on my radar.

But it has, and here we are.

So if you would like to know what we are hearing and seeing relating to real estate and the local market, here you go (and if you make it to the end, there is something funny awaiting you!)

A Week Later…

Last week, we held a meeting about COVID 19 and went through a slide deck laying out what was known and what the future would likely bring.

I think that the presentation got a lot of stuff right, but maybe I took a bit of an optimist’s view of things? The events of the last few days have convinced many of us that a bit more caution is probably appropriate. (Oh, and I do know how to say ‘authoritarian’ despite how badly I butcher it in the audio)

An Economic Sickness

One of the most difficult things to do in this day and age is to separate the signal from the siren. Twitter, Facebook, YouTube, and an endless supply of blogs and media outlets mean that pretty much anyone with an opinion has a platform. Essentially, this means that you can find a narrative to reinforce your world view.

So, whether you fall in the camp of ‘this is the black plague and we are going to die’ or the ‘this is the common cold and this all about nothing,’ the fact remains that COVID is a virus for which we have no immunities, and as long as it is around, we will need to engage in economically damaging actions in order to contain its spread.

Stated differently –– the only way to combat the spread of COVID is to decrease face-to-face interactions substantially –– which really hurts commerce.

And that is the core issue.

Richmond’s Economy

In 2008, Richmond got beat up pretty badly … but so did everywhere else. In the grand scheme of things, our market hit was in line with the average across the US. Places like Florida, Arizona, and California all took much bigger hits.

In COVID 2020, Richmond will probably be hurt less than many other places due to the fact that very little of our overall economy depends on travel and tourism. Richmond’s economy is underpinned by government, education, banking, and many other white collar jobs.

Places where travel and tourism are integral parts of the local economy will feel the impact of Coronavirus tremendously and those segments will likely be in shambles for the foreseeable future.

That said, Richmond’s restaurant scene is one of the country’s most prolific, and I am concerned about its ability to survive a prolonged slowdown intact. The best way to not come in contact with an infected individual is to avoid public places –– like restaurants. I sincerely hope that those who have the power to reduce the heavy tax burden borne by our restaurant community do so.

The restaurants are going to feel the pain first, the worst, and probably the longest.

Real Estate

From our perspective (real estate), we have not seen a notable difference –– yet –– but we do expect things to change in the following ways:

Sales Activity –– If you look at the YTD numbers, the market was roughly 20% ahead of last year in terms of transactional volume. Our MLS has tracked roughly 800 more contracts in 2020 than it had during the same timeframe in 2019. Demand was robust and inventory had dropped to all-time lows.

I would be hard-pressed to imagine this rate will maintain itself at the same pace. Expect activity to slow down, but rates being as low as they are will continue to drive many into the market.

Mortgage Activity –– Up until the financial market’s crash beginning a few weeks back, mortgage originators were already super busy with the spring market’s volume. And then, rates dropped to unfathomable levels, which triggered the most refinance business ever.

In other words, the mortgage industry was operating at full capacity BEFORE the refi boom and now it is operating at 150 to 200% of capacity. No business can continually operate above their capacity levels –– and especially not if ‘work-from-home’ becomes the norm.

Expect delays.

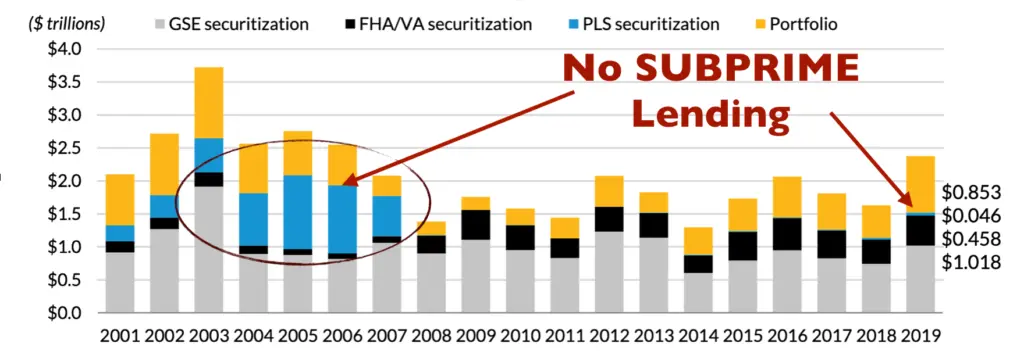

Underwriting –– Yes, demand is robust, but the good news is that demand isn’t ‘fake demand’ like it was in 2008 –– it is real. Underwriting guidelines are reasonable and no ‘subprime-type’ lending is propping up the market. In other words, legit buyers are in the market, and they are using fixed-rate mortgages. That is a good thing.

Mortgage underwriting is healthy.

Fundamentals –– If you watch the embedded video above, you will get a sense of where the underlying market fundamentals are. In short, despite the recent turmoil in the financial markets, the real estate market is healthier than it has ever been:

- Low inventory means no overhang if demand slows

- A nationwide deficit of 3.5M new homes means demand is still far greater than supply

- Low mortgage rates mean increased buying power

- Low oil / gas prices mean more disposable income

- Lower global demand means material prices for builders may come down

- Better home equity means enhanced ability to upgrade

- Low unemployment means more buyers

And, did I mention the stimulus that DC is pumping in the market as we speak? It is 2008-esque.

Right now, the market will likely slow some (it is inevitable) but once things return to normal –– Look Out! It will be insane.

Recommendations

Based on what we know and what we think is still to come, here is what we feel are the best courses of action:

- All buyers and sellers –– please have patience and above all else, HAVE A PLAN B. Mortgage companies are going to miss dates and that has a domino effect. Also, employers might look at reducing staff (or at least hours) which can impact a buyer’s qualification –– even after the contract has been ratified and loan application submitted. Expect delays and even higher-than-normal contract fall out.

- Sellers at upper price points –– be patient. The upper-end buyer tends to have more exposure to the financial markets and likely has lost a significant percentage of portfolio value. Expect traffic to slow and buyers to be cautious. So if you need to sell and sell now, moderate your stance on lower offers and inspection items.

- Sub $400k buyers –– there was less than 2 months of inventory in early March at the middle and lower price points. Multiple offer scenarios were common with in excess of 10 offers in many cases. Even if 50% of the demand goes away, that is still 5 offers. Don’t expect the more affordable price points to change dramatically.

- Mortgage borrowers –– get in front of the loan process. The system is moving as fast as it can so don’t expect it to be able to pull off miracles if you are behind in your paperwork and documentation. Get your stuff to your lender early and respond to requests immediately. I cannot stress this enough.

- And to everyone regardless of price or side –– work together to get deals done. If your counterparty needs time, give it. If you need to offer a rent back or restructure an offer to make up for a loss of cash in the market, you should. Renegotiating during the contract will become more commonplace in the interim –– so maintain a big picture view. Situations are changing rapidly and playing hardball will not yield the result you are looking for.

Summary

The sooner we can get this damned virus out of our system, the better for all of us. Yes, I get it that more people die from car accidents, cancer, and other maladies than COVID, but as of right now, we have to deal with it to move forward.

As I like to tell my kids, many times things aren’t your fault, but they are your problem, and telling me what should have happened isn’t going to fix the issue. Fix the problem now, get mad about it later.

That is what we all need to be doing.

No, you needn’t sweat the real estate market falling off a cliff –– this is not 2008. In 2008, the market was leveraged to the hilt and largely incapable of fixing itself. In 2020, the market was far healthier when Corona showed up.

Once this clears, we will return to a real estate market with fundamentals as strong as ever. And as a matter of fact, real estate may even benefit from the virus due to stimulus packages and a global economy in a recession. Despite how we look at the end of this thing financially, I guarantee it looks better than everywhere else on the planet.

So remember to take the long view. The hype is real, but hopefully short term. It may take a few months and some substantial behavioral changes to stop the spread of this thing, but we will.

Laughter is the Best Medicine

And lastly, a bit of levity.

Yesterday, the talking heads on CNBC almost lost it when the one announcer asked a guest if he ‘likes stimulus.’ Sorry for the adult humor, but this really struck me as funny (fast forward to about :22 to get to the funny part) and I think they found it funny, too.

Sources:

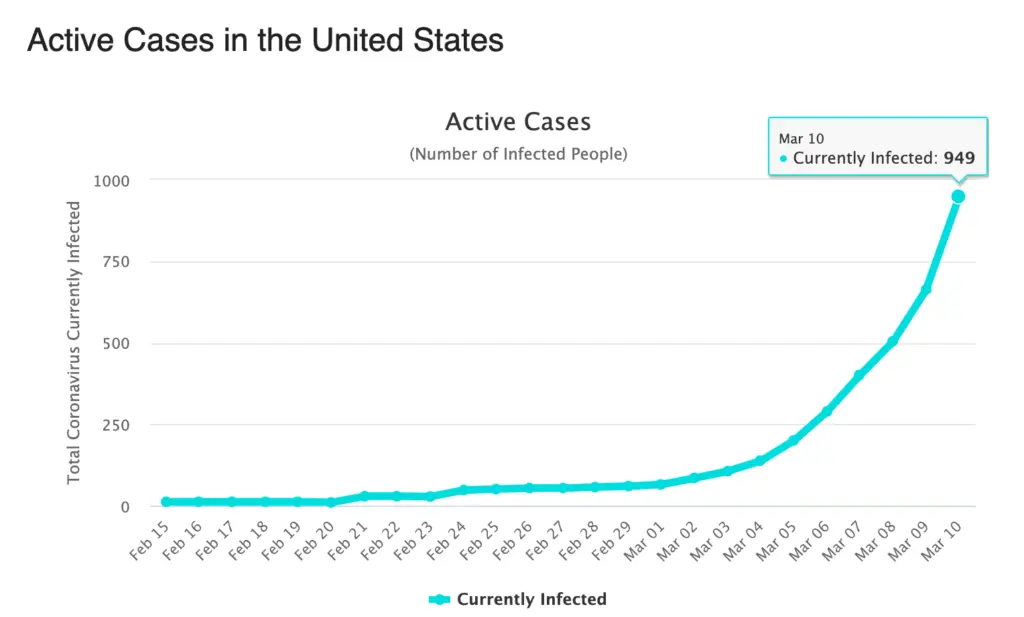

worldometer.info/coronavirus –– This site has become my go-to for all things COVID. It shows the numbers in the aggregate and by country. Yes, China and some other countries might not be entirely forthcoming in their reporting, but you can get a sense of where all of this stands.

Web Traffic –– This site tracks web traffic to various websites and I am keeping an eye on Zillow’s traffic to gauge the public’s attention to housing. As this blog is written, I don’t see a dip in traffic, but that could change.

One South COVID Presentation –– The market stats are good at showing market strength. This presentation was from March 4, and the spread of the virus was not as prevalent in the US at the time ––perhaps a bit more pessimism should have been included in retrospect. Also, I have now learned how to say ‘authoritarian’ better than I did in the video…