In case you hadn’t heard, 30 year mortgage rates rose this year.

After falling below 3% for pretty much the first time ever in 2021, rates began a rather jarring ascent in January and peaked just above 6% in June.

This is not news.

Since June, however, rates have since settled back to somewhere between 5.2% and 5.5%, but the world markets are twitchy, and volatility is still the name of the game –– so stay tuned.

Rates ≠ Demand

As rates have climbed, so has the noise about how rising rates were going to somehow end the bull market in housing.

Sorry, I disagree.

Why? Because the bull market in housing is not about rates –– ok, not exclusively about rates.

Mortgage rates matter for sure, but the long term prospects for housing is currently less about rates, and far more about the systemic and underlying fundamental issues that are not anywhere near being addressed.

Let’s discuss.

What Drives Demand

Ok, so the increase in mortgage rates will decrease demand for housing, right?

Nah.

Wait, what?!?

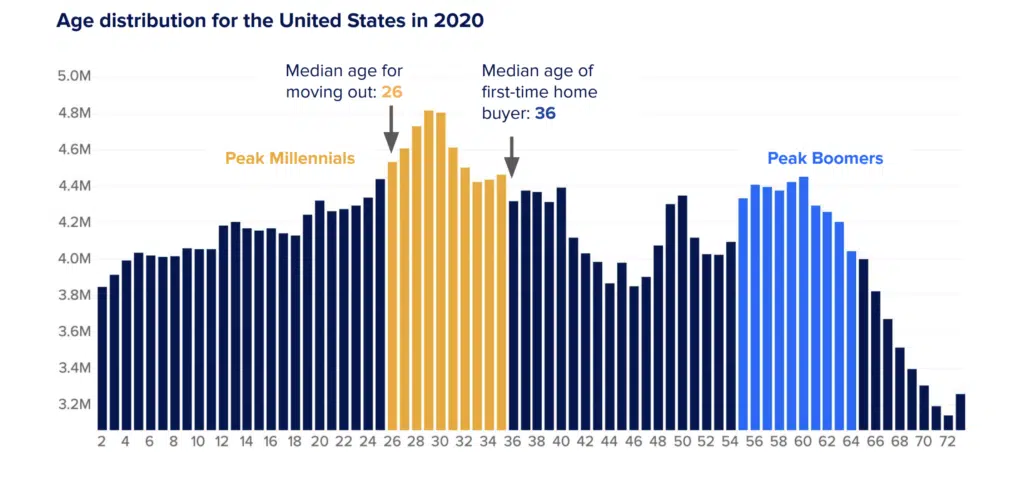

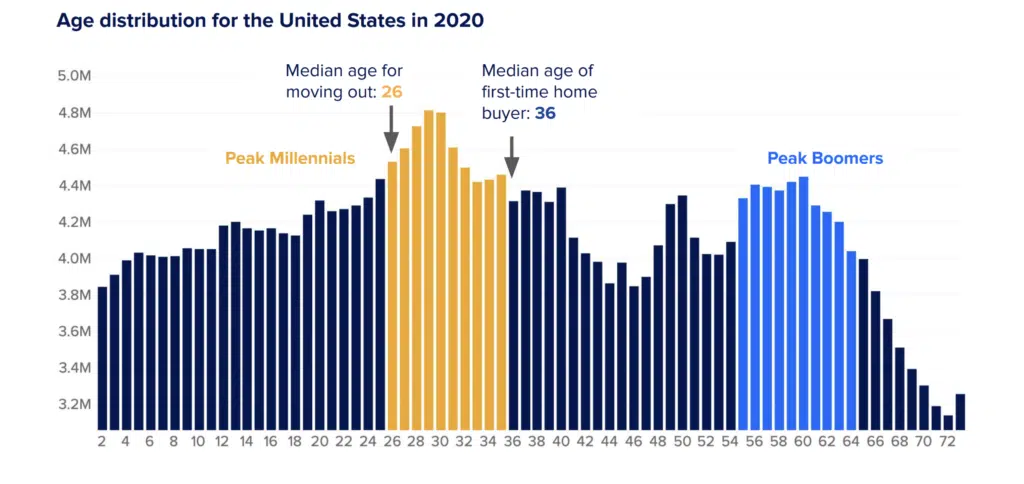

‘Higher rates = lower demand’ is a legit argument, yes, but here is the bigger one –– the Millennial Generation is the greatest consumer generation in the history of our country, they are just turning 30, and they are sick of getting pillaged by their landlords.

They want to own housing, just like every generation before them, but there is a total and complete lack of reasonably-priced housing options for them –– and thus the reason that that higher rates will have a minimal impact on demand and pricing.

Boomers and the 1950s Housing Boom

The last time we had a population bulge as pronounced as the Millennials, it began in the 1940s and 50s, due to the GIs returning home from WWII. The conflict-weary veterans wanted to forget about the horrors of war, settle down, get married, buy a home, and start a family.

And start a family they did –– we all know that demographic as the ‘Baby Boomers’ (aka Boomers.)

In order to satisfy the ravenous demand for the new ‘American Dream,’ the US construction industry managed to more than double its output from the previous decade to provide affordable housing options for everyone who wanted one –– it was the biggest increase in home building in our country’s history.

The leading edge of the construction boom began in the 1960’s and didn’t really cool off until the early 2000s.

But look what happened in the period after 2008 –– construction slowed dramatically.

The chart above shows the number of housing starts (new construction) adjusted for the population. In other words, ‘How many new homes were built for each person of population?’ That ratio should remain relatively constant through time in order to keep pace with population growth –– but it doesn’t.

As you can see, the rate of construction in the last decade is at least 50% lower, if not more, than every decade since the 60s.

And that lack of construction is now rearing its ugly head.

Small Housing is No More

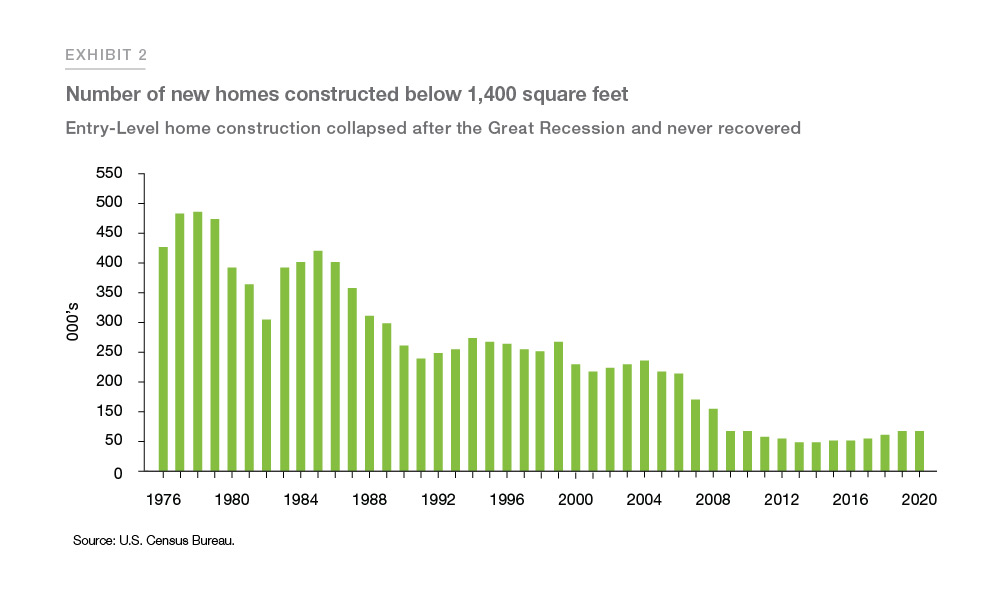

So not only are we building fewer houses, we aren’t building affordable ones either.

Anywhere from 35 to 40% of the homes constructed in the 70s and 80s was less than 1,400 SF. Today the number of newly constructed smaller homes is less than 10%.

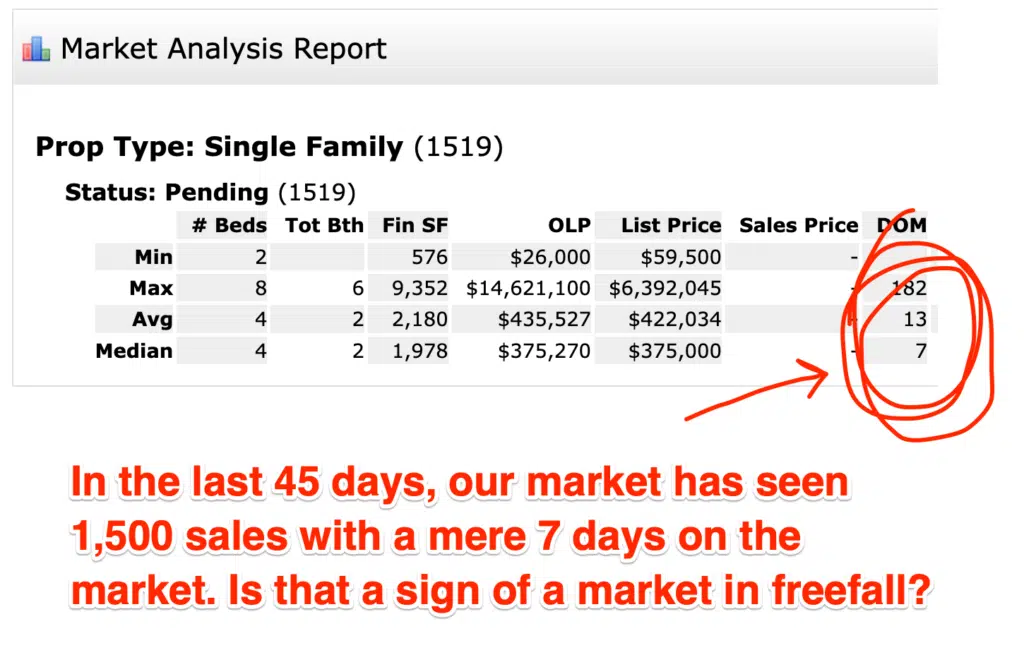

Our Market

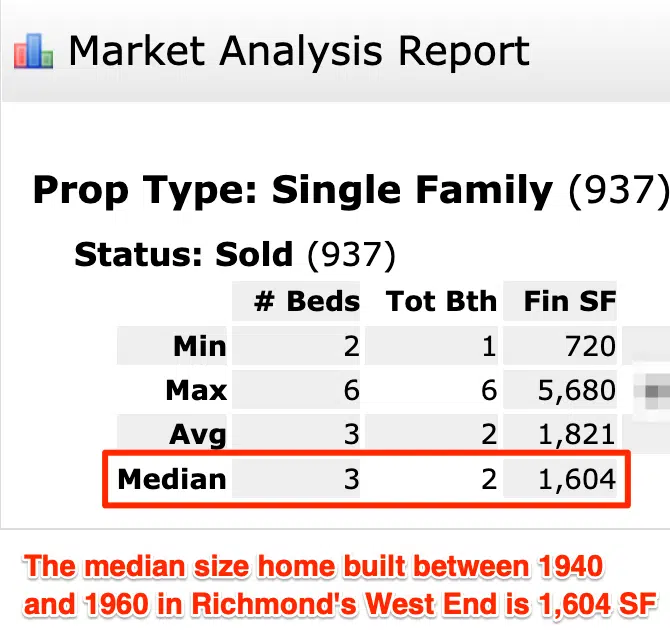

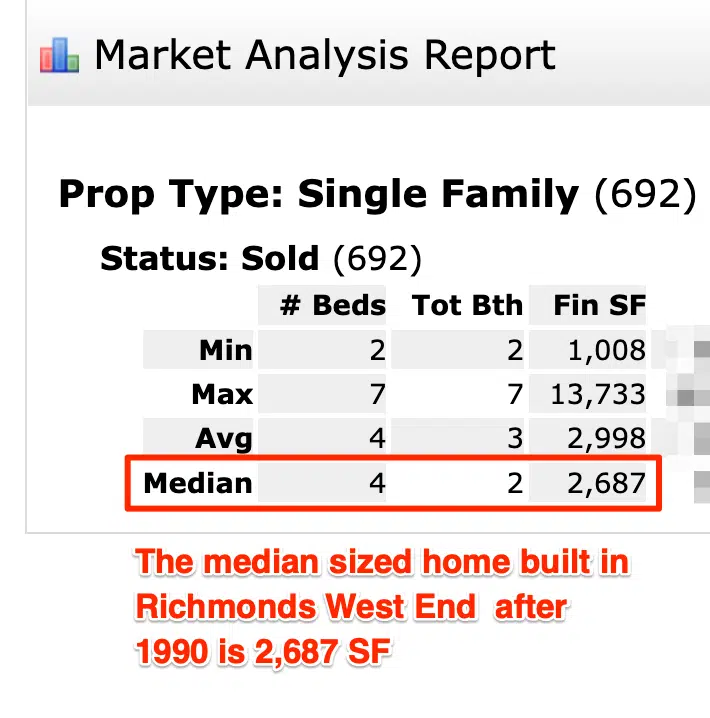

When I look in our MLS, I see the same thing.

A random sample of recent sales for houses built between 1940 and 1960 in Zone 22 (West End / Henrico) shows a median home size of 1,604 SF.

However, when you look at houses built later than 1990 in the same area, the median size jumps … substantially. For a myriad of reasons, the size of the homes we built in the last 30 years increased by over 40%, to 2,687 SF.

Bigger housing, and far less of it –– and we wonder why we have a housing crisis.

The Housing Deficit Isn’t About Mortgage Rates

“But rates are rising. that should take some pressure off the supply, right?”

Ask yourself, did the increase in mortgage rates:

- Make builders want to build more? Nope, builders have actually slowed down.

- Make developers want to develop more? Assuredly, no.

- Make people with 2.5% mortgages want to sell their home and move to another one? Actually, it has had the opposite effect. Owners with low rates are staying put for longer.

- Make investors want to stop acquiring rental properties? Of course not, investors buy with cash. They love the higher rates.

- Make investors want to sell their rental properties? See above. No way.

- Cause the local Board of Supervisors to suddenly decide to approve affordable housing developments? Nope, voting ‘yes’ to affordable communities is a guarantee to get voted out.

- Make NIMBYs suddenly have a change of heart about supporting affordable development? Not in the least.

- Make apartment owners want to lower rent? HAHAHAHAHA! That’s funny.

- Make all levels of government rethink their housing policies and repeal the layers upon layers of regulation that impede reasonably priced housing getting built? Uhhhh … no.

- Decrease the cost of building a home? Not one penny.

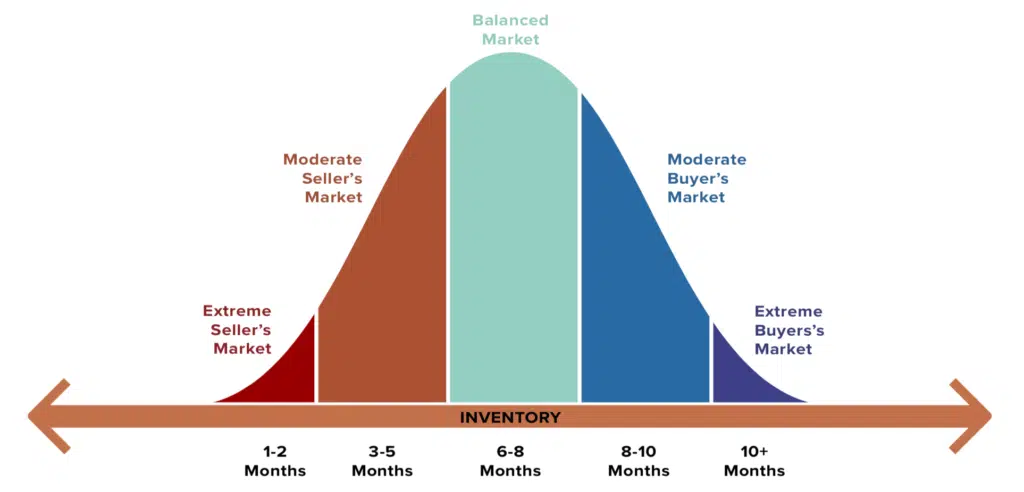

Sorry to restate the obvious, but there is nothing about higher mortgage rates that is addressing the undersupply. As a matter of fact, higher rates are actually MAKING IT WORSE.

Why? Because the increase in mortgage rates is slowing down the rate building and development AND it is making it easier for investors to acquire the affordable housing normally reserved for the entry point buyer –– which is the worst of all possible outcomes.

And thus, the idea that somehow mortgage rates in the 5s, 6s, or even 7s is going to magically create more housing at the price at which the median or affordable buyer can secure it is patently false.

Rates and Qualification

Another important point about mortgages that seems to get lost when rates rise is that rising rates impact what people qualify for, not whether they qualify at all.

In other words, even with higher rates, buyers are still approved for a mortgage, just a far smaller one.

It’s when you change credit score minimums, debt-to-income ratios, job history requirements, and other underwriting rules, than you change the number of potential purchasers.

However, when rates increase, you don’t erase demand, it simply shifts from higher price points to lower ones –– from say $400K down to 300K –– which just increases the pressure on the one segment where the inventory is essentially fixed.

Removing access to subprime loans in 2008 shrank the buyer pool.

Rising rates in 2022 shifted the buyer pool.

it is a key distinction.

And remember, the lower a buyer moves in price, the fewer houses there are to choose from –– and (unfortunately) more cash investors to compete with.

The dreaded double whammy for the entry level buyer.

This Shouldn’t Be a Surprise

People forget that in 2017, 2018, and 2019, the market was already experiencing rapid price increases, bidding wars, and plummeting inventory. All the leading red flags that the market did not have the housing supply to handle Millennial demand were waving wide and high –– and we did nothing about it.

Remember, mortgage rates hovered around 4.5 to 5% in 2018, and a record number of homes were sold at that time. And I won’t mention the mortgage rates in the 1980s and 1990s and the number of homes sold.

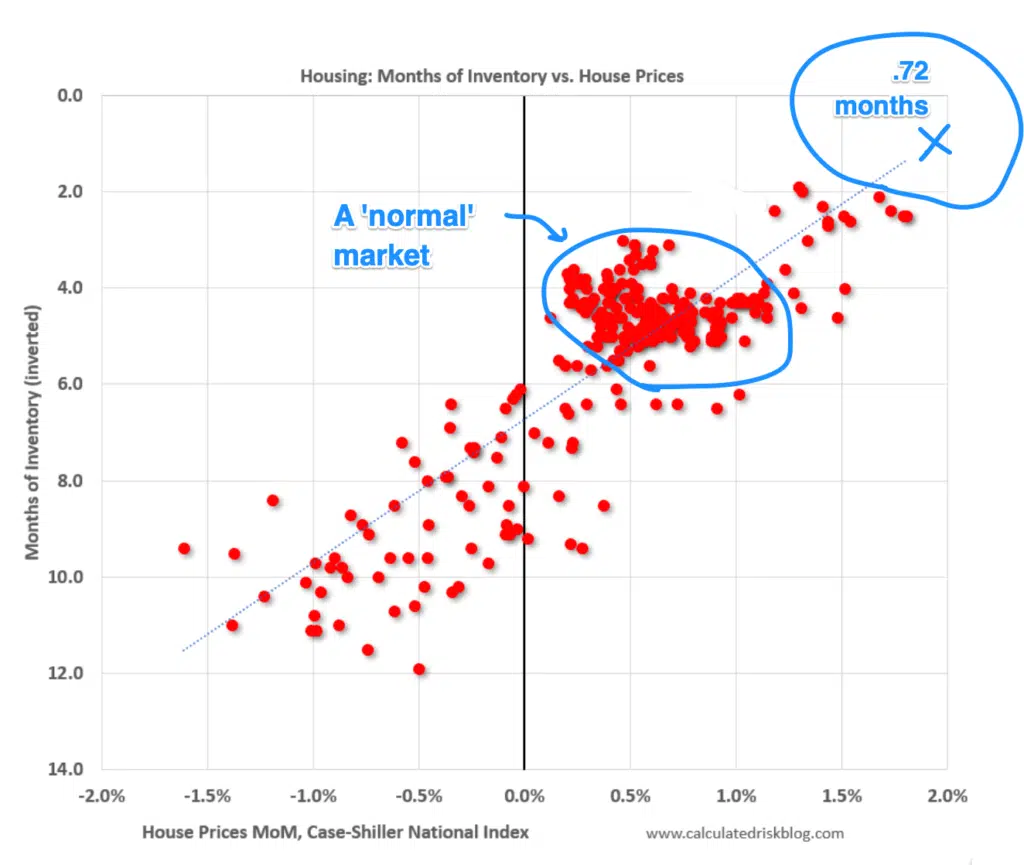

So don’t assume that sales, pricing, and 30 year mortgage rates are perfectly correlated –– because they aren’t.

Do Rates Really Matter?

I know, I know –– I can’t actually be so naive as to believe that when you make a mortgage payment nearly twice as expensive as it used to be, that won’t have an impact?!?

In the interim it might, sure. But I am talking about over the next few years and beyond, not the next few months.

When rates started to jump this spring, many prospective buyers elected to take a ‘home search sabbatical’ largely due to interest-rate-sticker-shock or perhaps delusions that somehow home prices will fall back to 2020 levels.

But my contention is that the ‘wait and see’ approach that many buyers adopted as rates jumped will prove to be futile. The 3% mortgage is now a thing of the past and a 30% price decrease is exceedingly unlikely for all of the reasons stated above –– especially at the median and lower price points, and / or mature areas where the supply of housing is essentially fixed.

No, once the lease renewal comes back with another 10-15% increase, buyers will swallow hard and accept the current rates as the new normal –– and we will be right back to crisis mode.

2023 and Beyond

I get it, when COVID arrived in early 2020 until today, prices spiked. By most estimates, prices across the board increased +/- 30%, depending on your market and the price point.

A 30% increase in 18 months feels unnatural, and 2008 so ably taught us that just because the housing market hadn’t crashed since the Great Depression, it still could.

So I get the fear. A lot of people still have scars from the last downturn –– myself included.

But this isn’t 2008.

Will the prices pull back some this fall, or even next spring? Perhaps, but there is conflicting evidence. Some regions have seen more softness than others, while some (like ours) have continued to plow right ahead.

And thus, I encourage everyone to look at the market fundamentals and not simply have a knee jerk reaction to the noise.

I fully acknowledge that a 5.5 to 6% mortgage rate seems high when 12 months ago they were 2.8%, but when your choice is between a $2,500/mo rental payment (rising 15% per year) and a fixed rate 6% mortgage, the answer becomes painfully obvious.

So before we write off the entire market and declare ‘2008, The Sequel!’ just because rates increased to somewhere still shy of historical norms, look at what lies beneath the surface –– a housing availability crisis that is colliding with the biggest population bulge in US history.

The bottom line is that there are more people who want houses than there are houses to go around, especially in the median and lower price –– and that is not only highly unlikely to get better for quite some time, but very likely to get worse.

A Few Notes / Other Thoughts

The New York Times wrote a great op-ed about the housing crisis that I think is 1,000% correct. It requires a free registration in order to be able to read, but totally worth it –– We Need to Keep Building Houses, Even if No One Wants To Buy

After I hit ‘publish’ on this article, the following post showed up in my Twitter feed, it was written in March 2022, so it is a little bit dated, but I would say that either Twitter was spying on me or I am not alone in my opinions –– Home Buyers: Don’t Wait for Prices to Drop in 2022

Finally, a great piece that proposed a counter to the argument that we have a housing undersupply. I am not sure I agree, but the author makes some interesting points –– How Much Housing Do We Need?