Forgive me, readers, for I have sinned. It has been 4 months since the last blog. Got busy, you know? Had a lot going on this year.

But that said, there is no better time to jump back on the writing horse and no better topic than the predictions for the coming year, which has become a bit of a tradition on the blog.

So without any further adieu, here are the things we are keeping an eye on and some trends we are seeing (and feel we will continue to see) as we move through the next 12 months.

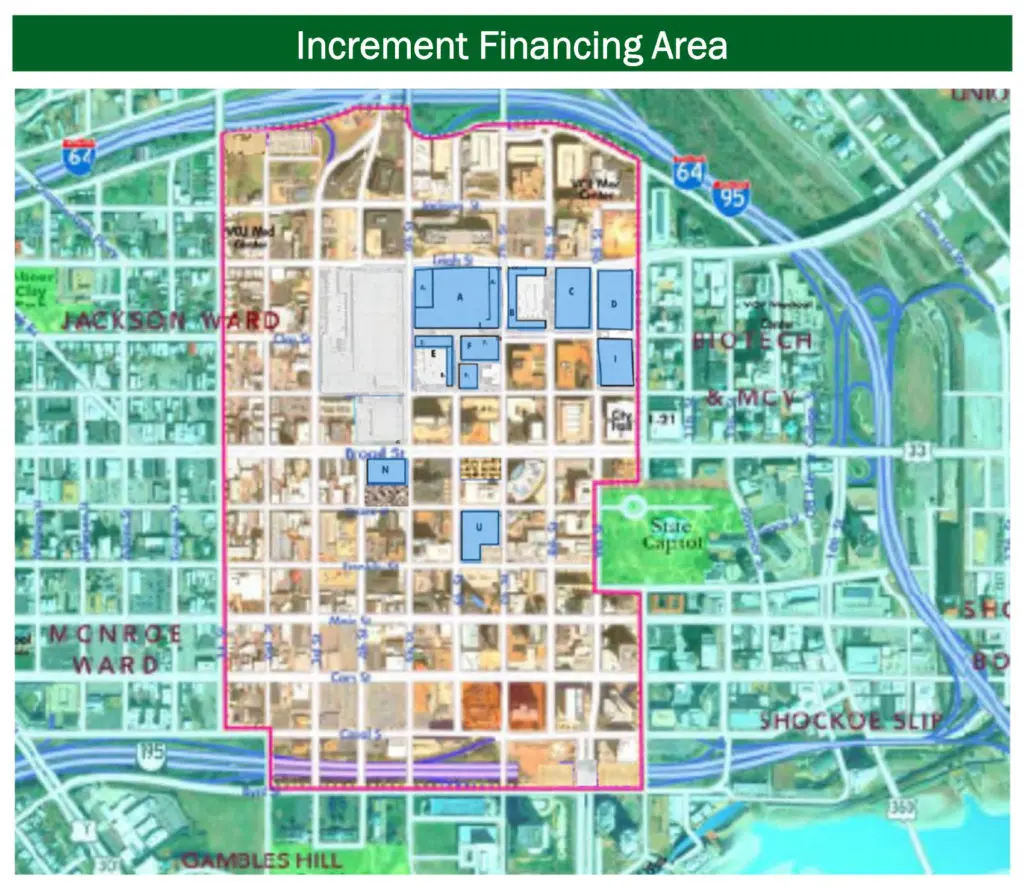

Navy Hill

For those of you who are not aware of Navy Hill –– well, you should be. Navy Hill is the proposed redevelopment of the Richmond Coliseum and the surrounding blocks into a new 18,000 seat arena plus beaucoup office, residential, and retail space.

When completed, it stands to be the most transformative project the city has seen in 50 years.

To say the least, it is a pretty big deal.

Opposition is Loud

Any development project will bring with it its share of opposition, whether it is a simple townhome project or a large planned community –– that is the nature of development.

But when you start talking about a project on the scale of Navy Hill ($1.5B, if you are asking), then the opposition increases exponentially.

And thus it is with Navy Hill.

So as the noise gets louder, make sure to separate logical and thoughtful opposition from the ‘I don’t like change’ opposition. Sometimes it is difficult to tell the two apart.

So 6th Street Marketplace Redux?

So what makes this project different than, say, the 6th Street Marketplace debacle of the 1990s, or the ‘comedy-of-errors-effort’ at building a baseball park in Shockoe Bottom, or even the horrible deal cut with the Redskins for training camp?

Well, two basic reasons:

- The development team is extremely accomplished at sports arena/ballpark redevelopment

- The city isn’t acting as developer, they are SELLING the land to a private development group

The TIF (not the TIFF!)

The basic deal is that the city is selling the land to the developer and then using a form of financing called a TIF Overlay District (Tax Incremental Financing) to pay for the new arena and infrastructure.

The tax revenues from the improved values in the district would be what pays off the debt –– and once paid off, the city would not only own the arena outright, but they would have an insane amount of new tax revenue flowing into their coffers.

Good News. Bad News.

The good news –– the City will NOT be the developer. The City of Richmond has repeatedly shown that they are terrible at playing developer. And (more good news), they will have activated a tremendous amount of taxable land in the middle of Downtown that currently brings them no revenue.

The bad news –– well, what if it doesn’t work as planned? And don’t the schools need money now?

Yeah, there is that …

Ambitious, But Transformative

The plan is ambitious for sure, but the development team is extremely accomplished. The lead architects were involved in some of the most high profile sports arena developments in the US –– Quicken Loans (Cleveland Cavaliers), Staples Center (LA Lakers, Clippers, and LA Kings), and America West (Phoenix Suns) to name a few.

I, for one, would love to see it happen. The number of concerts, sporting events, and other entertainment productions that skip Richmond currently is frustrating –– especially for a lifelong Richmonder accustomed to seeing of the best shows ever right here at our own Coliseum.

Furthermore, the idea that something like 10 Downtown blocks are currently NOT providing revenue (it actually costs money to maintain so it is technically a drain on revenues, but who cares about such minor details) to a city in such desperate need of fixing its crumbling schools also appalls me –– especially when you see the impact that a sports/entertainment district anchored by office, retail, and residential development has had on other cities.

Yes, the schools are in dire need of additional funding, but so is every other department. When your revenues are fixed, paying Peter means robbing Paul.

So stay tuned –– there is a lot more to be said and written about Navy Hill.

Moving East

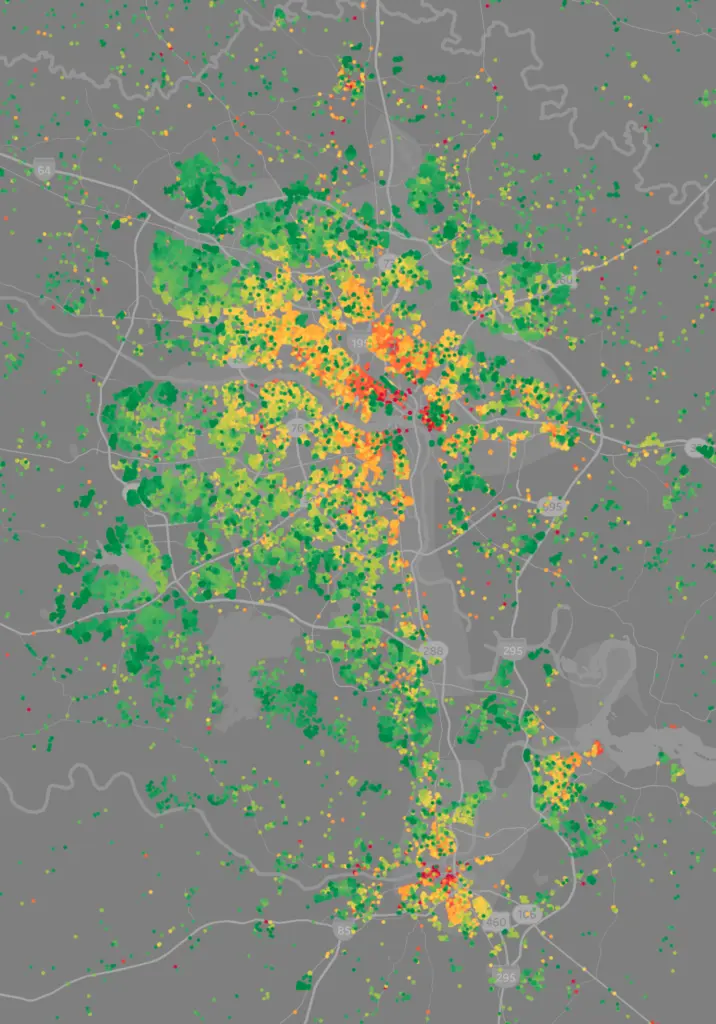

Have you ever really looked at a map of Richmond’s development?

If you have, you are one of the few.

By and large, it moves from the fall line of the James River (i.e. Downtown) and moves primarily up the river (west and north) and out Midlothian Turnpike, Hull Street, Broad Street, and along 95.

What it does not do is move east at anywhere near the same pace as it does in the other directions (see the map.)

Well, that is starting to change.

The Rise of the East

Back in the days when the cleanest air and water were upwind and upstream, moving west made a lot of sense.

Today, the impact of pollution isn’t nearly the same as it was in say, 1930, and thus the need to continually go west isn’t nearly as strong. And the quest to find reasonably priced housing that isn’t 45 minutes from urban Richmond is leading the change in attitudes.

The first chart shows the $/SF of the two easternmost high schools in Henrico County (Varina and Highland Springs.) Look not at the amount per square foot –– but the rate of change –– when compared to the two westernmost high schools in Henrico (Godwin and Deep Run.)

Bet you didn’t expect that, did you?

Now, take a look at what is happening in the North Church Hill neighborhoods, as well as those to the east of Chamberlayne between Laburnum and Brookland Parkway.

Notice anything? Oh, just pricing that is up anywhere from 3 to 5x since 2011.

Wait, did you say 300 to 500% since 2011?!? Yep.

Affordability

What is driving the change? Affordability (well, at least for now.)

As the prices for entry to the Fan District, Museum District, West End, and even the new home communities in Midlothian and Moseley are reaching into the middle to upper $400’s, people, especially the first-timers, are looking for housing that is both affordable and close in.

Check out the pricing for new housing in four of Chesterfield’s largest new home communities on the chart below:

Cue ‘the east.’

Pricing below $400k, 10-15 minute commutes, and a rapidly growing amenity base are what is underpinning the growth –– and as more and more investment occurs at points east of 95, the better the appreciation will get.

The smart investors are already there.

Inventory

A Growing Metro

Question –– do you know what the rate of population growth is right now in the Richmond region? (And by region, I mean the City of Richmond and surrounding counties)

Answer –– Depending on what you read, the population growth in the region is between 1% and 1.5%.

Now that doesn’t sound like a big number until you do the math.

1.3M people x 1% = 13,000 new people each year.

That is a little over 1,000 people per month.

And that is roughly 35 people per day.

Think about that number for a second –– 35 new people per day are moving to Richmond. WHERE IN THE WORLD ARE THEY GOING TO LIVE?

Now you see the problem.

Median Income

Want me to blow your mind even more? The median income in our region is $65,000.

$65,000 translates to roughly a $250,000 to (maybe) $300,000 home in terms of buying power.

Guess what? There is less than 2 months of inventory below $300k in the Richmond region.

Spoken differently, there is twice as much inventory ABOVE $300k than there is below it.

So here we are.

Crisis Mode

Several years ago, we wrote about the coming affordability crisis in housing. Well, it is finally here –– and inventory (or the lack thereof) is the primary culprit.

To quote the great Roger Daltry –– Meet the new boss, same as the old boss! (and I start the video right at his famed scream …)

So until we either find another 1,000 acres in the middle of the city (not going to happen,) or we rewrite mortgage financing to allow for vertical development (not happening fast enough,) we are going to keep seeing prices spike –– especially in the more affordable segments.

Manchester

We were just in Manchester doing a video shoot for one of our listings and man, it has gotten tall. Like really shockingly tall. And I would like to think that I know a lot about Manchester and even I was shocked.

It is tall.

< Don’t believe me? Check the references to ‘Manchester + Tower‘ in Richmond Biz Sense >

For those who do not know much about Manchester, you should. It is basically becoming an entirely new city.

The amount of development that has occurred in manchester is unprecedented, especially by Richmond standards. Towers, towers, and more towers are now the norm, as is new retail, new residential, and new office.

And did I mention the towers?

Housing

So what impact do you think all of this development had on house prices in Manchester? Yeah, you guessed it –– they went UP!

If you haven’t been to Manchester in a while, I highly suggest you walk the T Pot Bridge, grab a beverage at Legend, and take a look. You won’t believe the activity.

What We Didn’t Talk About

So we left off several topics in hopes of a) making this post of reasonable length and b) leaving something else to talk about over the coming year.

But here are some of the things we did not touch on:

- iBuying –– having a company like Zillow buy your home

- Building Costs –– still going up!

- Politics –– sorry, I don’t have the stomach to write about it

- Scotts 2.0 –– the Westwood Tract redevelopment (i.e. the industrial neighborhood just west of Scotts Addition)

- Sauer Center –– can I please just have my Whole Foods?!?

- 2020 Census –– should be interesting, to say the least

So look for us to tackle a few of these topics in the coming months.

And Finally …

2019 was another banner year for One South. We got a lot done.

Performance Metrics

We broke our prior year’s record for transactional volume.

We cracked the Top 10 in volume (by office) in our MLS.

And we still outpace the market averages in pretty every important metric:

- Median Days to Sell –– 8 days

- Median Percentage of Asking Price –– 100% (yeah, that’s not a misprint)

- $/SF –– $31 above the market average

- Price –– $30k above the market average.

AND we have continued to conduct our business in an ethical manner (i.e. –– another year of a spotless record with all of the governing bodies.) That makes me especially proud of not just One South’s agents, but of the management team and staff who play a huge role in both our agent’s success and our consumer’s experience.

So to summarize –– more transactions at higher prices with smaller discounts and at a faster rate than the market, all while maintaining the highest level of ethical behavior –– not too shabby.

Expansion

We also grew geographically.

We recently opened another satellite office in White Stone, Virginia (along the Chesapeake Bay) and are in the process of partnering with a videography firm to even better promote the listings we carry and the neighborhoods we frequent (more on this soon.)

Commercial

And did I mention how well our commercial team is doing? Just read Biz Sense and you will get a sense of how well …

The One South Commercial team continued to grow their name and presence with more high profile sales, additional team members, and a new best for volume.

In Closing

We fully expect 2020 to be another banner year for us as the economy remains strong, interest rates low, and our region continues to attract new residents.

Most prognosticators expect the market to get started even earlier this year (but that also depends on the sellers and the weather, so stay tuned.)

And while we expect to see a bit of a slowdown around the election (it happens every election year), don’t sweat it –– just plan accordingly.

Thanks and we look forward to serving you in the coming year!